BUSINESSES LOOKED TO THEIR INSURANCE COMPANY FOR HELP

Business owners across Texas are studying their business income coverages as their insurance companies deny their claims. In county after county, across the State, business were forced to close their doors to customers. No customers meant no money to these businesses. From restaurants to gyms to salons to dentists to hospitality industry and everything in between. Most businesses felt the hit of the government-mandated closures while trying to keep their staff employed. When they turned to their insurance companies for relief, they have met with resounding rejection. Citing myriad of provisions in the obscure policies, the insurers gave various and multiple reasons for the rejection. But all assert that the Business Income coverage required “direct physical loss or physical damage” to the insured property.

ALL RISK INSURANCE?

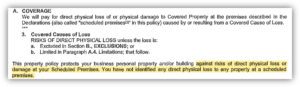

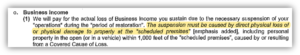

The policies purchased by these business are considered to insure against ALL RISKS. That means that all loss of or damage to the insured property is covered UNLESS it is excluded. The coverage grant that pertains to the business income losses reads like so:

And the specific business income coverage provides the coverage portions with similar language:

PHYSICAL LOSS “OF” OR PHYSICAL DAMAGE

It will be litigated what the expression “physical loss of” versus “physical damage.” Insurance companies are taking the myopic position that unless the businesses’ physical property was “damaged” by the virus, then there is no coverage. That begs the question of what constitutes “insured property.” If a business purchased business income coverage, and the coverage would replace lost “income,” it would seem that part of the “insured property” thus insured is the income itself. To require the actual walls and countertops to be infected with the virus just seems to narrow. Especially because these policies also have “civil authority” coverage to offset the lost income in the event of a government-mandated closure.

In any event, authorities are mixed to say the least with some Courts finding coverage, whereas others finding a lack of coverage unless there is actual physical damage to the insured property (as defined in declarations):

- Embargo on beef because mad cow disease not physical. Source Food Technology Inc. v. USF&G, 465 F. 3d 834, 838 (8th Cir. 2006)

- Possibility of loss or fear of loss not enough (airlines claims denied following 9/11 when they were required to close). United Airline, Inc. v. Insurance Co. of the State of Pennsylvania, 385 F. Supp. 2d 343 (S.D. N.Y. 2005) aff’d 439 F.3d 128 (2nd Cir. 2006)

- But dust in the air and particles following the collapse of the World Trade Centers was evidence of “direct physical loss of or damage to.” Schlamm Stone & Dolan LLP v. Seneca Ins. Co., 6 Misc.3d 1037, 2005 WL 600021 (N.Y. Sup. Ct. March 4, 2005).

- Air and smoke from nearby wildfire constituted “direct physical loss of or damage to” insured property. Oregon Shakespeare Festival Ass’n v. Great American Insurance Co., 15-01932 (D. Or. Mar. 6, 2017) (vacated at joint request of parties).

In addition to meeting the loss of or damage to language, many businesses are looking to the fact that they were ordered to close their business by government officials and they thought they had coverage for that.

CIVIL AUTHORITY

General requirements for coverage under Civil Authority:

- An order by a civil authority;

- Prohibiting access to the property;

- Due to physical damage; and

- Caused by a covered peril under the policy.

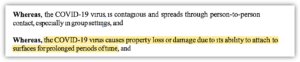

Most policies read like this: Most policies have up to 4 weeks or 30 days of coverage if the closure is by order of Civil Authority. In addition, some governmental orders have made affirmative findings of direct physical loss of or damage to:

Yet, there will be litigation on the nexus between the Order and the Loss, which came first, and whether the physical element was satisfied at an adjoining property. And, to the extent some businesses were partially closed, whether the “specific prohibition” of “access” is met.

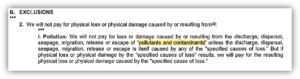

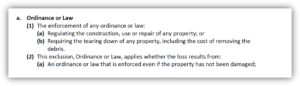

EXCLUSIONS

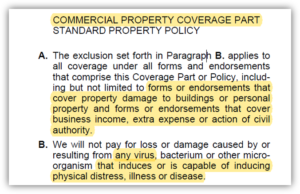

Insurance companies have used multiple different exclusions to deny coverage to policyholders. Those include pollution, fungi and microbe, acts of government (or inaction), as well as a virus exclusion that was created in the early 2000s. Some sample exclusions are:

Pollution:

Loss of Use:

And, finally, the VIRUS Exclusion – ISO CP 01 40

Under Texas and general law, the insurance companies will bear the burden to prove that these exclusions apply and they must unambiguously apply to except the coverage they are being used for. It will lead to litigation on the Reasonable Expectation Doctrine.

“REASONABLE EXPECTATION OF COVERAGE”

Whether the exclusions will shield insurance companies from liability may come down to an old insurance coverage doctrine – the Reasonable Expectation of Coverage doctrine.

“The objectively reasonable expectations of applicants and intended beneficiaries regarding the terms of insurance contracts will be honored even though painstaking study of the policy provisions would have negated those expectations.” Robert E. Keeton, Insurance Law Rights at Variance with Policy Provisions, 83 Harv. L. Rev. 961.967 (1970). “As worded, the doctrine allows courts to overturn express contract language if the term contradicts the consumer’s reasonable expectations.” Robert A. Hillman, Jeffrey J. Rachlinski, Standard-Form Contracting in the Electronic Age, 77 N.Y.U.L. Rev. 419, 459 (May 2002).

To what extent this doctrine will be a means to extend coverage to the insured’s losses, even if just the 30 days of civil authority, remains to be seen. Insurance companies will argue that this doctrine should not apply in Texas. However, in Utica Nat’l Ins. Co. of Texas v. American Indemnity Co., 141 S.W.3d 198 (Tex. 2004), the Court expressed a “reasonable expectations” doctrine in contract interpretation, noting the following: “Reasonable expectations are often affected by the conditions surrounding the formation of the policy language and by the type of clause at issue . . . ‘The court must adopt the construction of an exclusionary clause urged by the insured as long as that construction is not unreasonable, even if the construction urged by the insurer appears to be more reasonable or a more accurate reflection of the parties’ intent.’” (quoting Nat’l Union Fire Ins. Co. v. Hudson Energy Co., 811 S.W.2d 552, 555 (Tex. 1991)).

CONCLUSION

In these uncertain times, it is double-troubling for businesses to have to battle with their insurance companies. Firms like The Brasher Law Firm are here to fight for them. We review policies for free and only accept cases on a contingency – meaning, if we do not recover, we do not get paid. As a firm, we are passionate at defending policyholders from scrupulous insurers and holding those insurance companies to the promises they sell.